Google is advancing in quantum computing developments, which brought fear, uncertainty, and doubt (FUD) to the cryptocurrency investment community. Crypto traders reacted to Willow-related news with a panic selling event that liquidated over $1.6 billion in 24 hours.

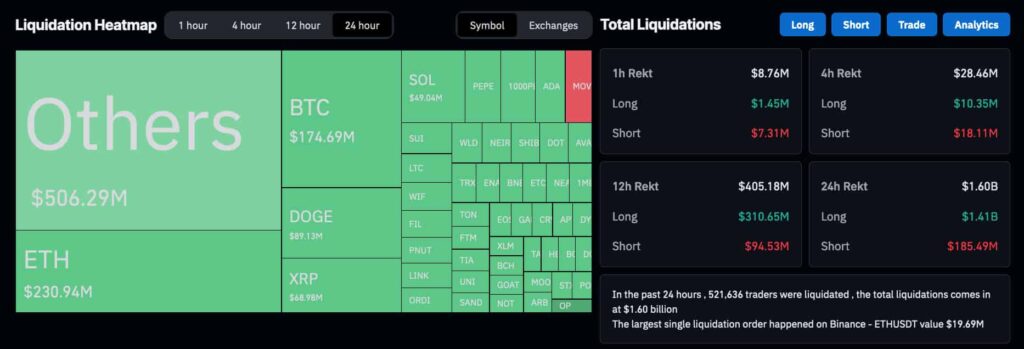

According to data Finbold retrieved from CoinGlass on December 10, quantum computing fears liquidated over 521,000 traders in a single day. This was one of the highest 24-hour crypto liquidations since 2021, affecting most long-position traders.

Notably, $1.41 billion out of the $1.60 billion total was of long positions, representing a massive long squeeze. “Other” altcoins dominated the liquidations, with over $506 million flushed out from these low-cap cryptocurrencies.

However, the largest single liquidation occurred on Binance with the Ethereum (ETH) pair against Tether’s USDT. The trader lost $19.69 million out of $230.94 million in liquidations on all Ethereum pairs. Bitcoin (BTC) was the third most affected cryptocurrency, with $174.69 million in 24-hour liquidations.

Google’s Willow: Quantum computing developments and crypto

In a recent announcement, Alphabet Inc (NASDAQ: GOOG/GOOGL) introduced Willow, a quantum computing chip with 105 Qubits. This marks a huge milestone in quantum computing research and development, with Google leading the industry into groundbreaking technology.

Essentially, Google claims Willow solved a computational problem in five minutes that would take a current supercomputer over 10^25 years to solve. This poses a threat to today’s cryptography protections, including cryptocurrency wallets, which triggered the panic selling.

Experts have weighed in on the issue and explained that while Willow marks a significant development, it is still not enough to crack Bitcoin and other cryptocurrencies. Some, like Charles Edwards, expect a real threat in the following five to ten years but urge for improvements.

“Whether its 3, 5, 10, 15 years away isn’t the point, the point is action needs to be taken TODAY. It’s good everyone is talking about Quantum Computing today, perhaps it will finally start to be taken seriously.”

– Charles Edwards

Dave Diamond, for example, explained that Google’s announcement is a gift to the crypto industry, as it allows for preparation. Meanwhile, core developers of popular projects went to X to explain that they were already researching and developing quantum-resistent solutions.

What’s next for crypto?

From an investment and trading perspective, analysts have deemed the quantum computing panic-selling a FUD worth buying. Income Sharks believes this is “one of the most bullish things” to altcoins, giving traders “some really good entries.”

Alex Krüger seems to agree, commenting that “nothing changed” in a macroeconomic perspective, expecting “prices to still go up.

“Today’s was a major leverage flush out. Mainly for altcoins,” Krüger posted. “Very normal in hot and highly levered markets. This is how crypto baptizes newcomers and keeps crypto natives disciplined. Otherwise, we would all be running at 10x portfolio leverage straight to Valhalla.”

As things develop, traders, investors, developers, enthusiasts, and critics weigh the possibilities, threats, and opportunities following Willow’s results. Overall, quantum computing advancements are inevitable, and, like always, the technology will need to adapt and improve with it.

Featured image from Shutterstock.

The post Quantum computing fears liquidate $1.6 billion of crypto trades in a day – What’s next? appeared first on Finbold.