In a recent podcast episode, executives of a top 100 cryptocurrency unveiled a market manipulation scheme by the FTX exchange. The now-bankrupt FTX has allegedly operated many similar market manipulation activities, intentionally harming some projects for the benefit of others.

On October 12, the Full Shard Podcast aired its first episode featuring three co-founders of the MultiversX Labs, formerly Elrond. Starting at around 00:55:00, Beniamin Mincu, Lucian Mincu, and Lucian Todea discussed their experience with FTX’s market manipulation.

According to the three executives, Sam Bankman-Fried’s bankrupt exchange engaged in massively pumping, farming, dumping, and then shorting MultiversX tokens. These actions, as discussed, were primarily responsible for EGLD’s volatile price action in the early days, significantly harming the project.

Other cryptocurrencies were also affected

Moreover, Lucian Mincu explained that talks to other crypto executives and founders revealed a similar negative experience with FTX activities. In particular, the leading developer mentioned that Avalanche (AVAX) was also “farmed very, very properly,” according to talks at events.

“From where I come from, people try and do good stuff. They help each other, and there is a reputation for people being helpful with other founders. For those guys [FTX] I never heard any of my friends ever mentioning their name or at least [not] in a positive way.”

– Lucian Mincu at the Full Shard Podcast Episode #1

Lucian Mincu added that even after ten years in this space with “pretty much the most relevant people,” he never heard “at least one single builder saying one good word that he had been helped in any way by Alameda or FTX.”

In this context, Sam Bankman-Fried was charged and investigated of market manipulation through Alameda and FTX activities, as The New York Times reported. These activities could have led to the collapse of two cryptocurrencies, TerraUSD (UST) and Terra (LUNA), reportedly for the benefit of FTT and other projects Bankman-Fried supported.

FTX market manipulation: pump, farm, dump, short

Commenting further on the matter, Beniamin Mincu highlighted how FTX maliciously used the existing incentives – created to foment the ecosystem. As explained, “Incentives drive some people to behave in ways you would never expect,” which unintentionally facilitated the manipulation.

“It is one thing for someone to farm you for tens or hundreds of millions and another thing to use that money very intentionally to bring everything down, profit as much as possible, and so forth.”

– Beniamin Mincu at the Full Shard Podcast Episode #1

Lucian Mincu said he remembers seeing an FTX position worth between $100 to $200 million at that time.”The mechanics were even more evil than what people would have expected anyone to be,” he concluded.

Previously, Lucian Todea commented how “farming” would usually mean a good thing in crypto, giving yield opportunities. However, FTX’s market manipulation taught him how it can also be used for nefarious intentions, directly harming a well-intentioned project.

How FTX’s market manipulation affected MultiversX (EGLD)

Todea and the Mincu brothers went through more details on how the FTX market manipulation occurred and affected MultiversX (EGLD). Finbold also recurred to DavyCrypto, DeFi enthusiast and ambassador of grassroots MultiversX projects, for more information on what happened.

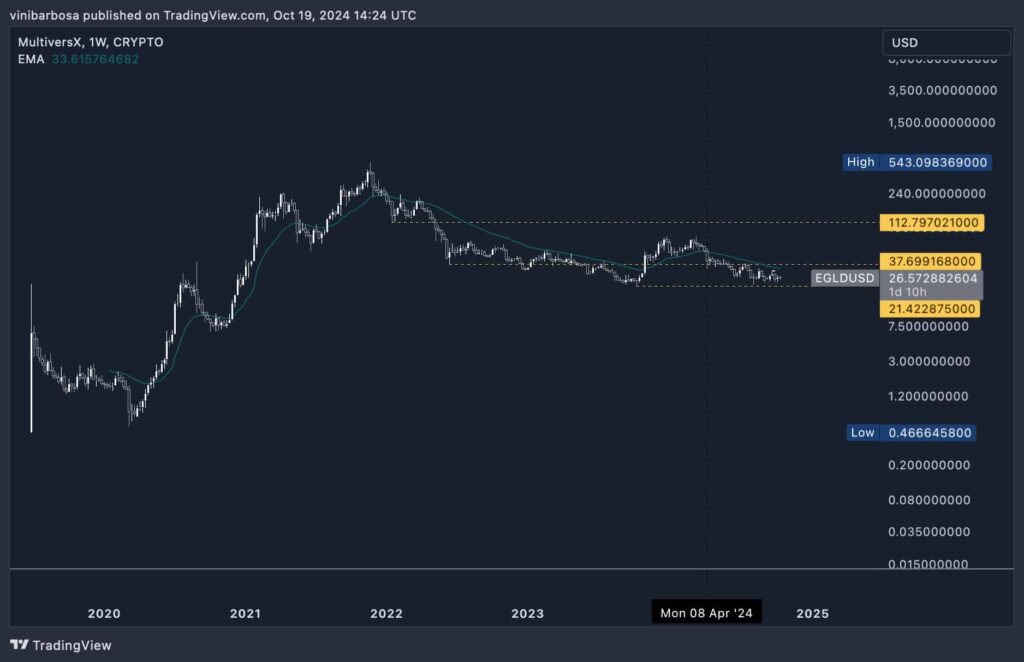

As described, the institution’s actions consisted of buying large amounts of EGLD to stake in the recently launched Maiar Exchange. The demand pressure pumped EGLD’s price to an all-time high of around $540. This was the first phase.

Then, FTX and other entities collected significant amounts of the staking rewards paid in the airdropped token MEX. Moving forward, these MEX tokens were exchanged for EGLD, which were then partially sold in the spot market.

“Big whales came, buying EGLD, farming on the DEX, and selling MEX reward tokens instant. This drove up the price a lot for EGLD and made MEX perform poorly. Once they decided they had enough of MEX, they started to sell EGLD and hedge their position.”

– DavyCrypto for Finbold

Moreover, the unsold positions were used as collateral to open short positions against EGLD, dropping the price even further. By January 2022, EGLD had crashed to a local bottom of $112.79 and by June to $37.69. The token entered a downtrend, going to as low as $21.42 after its all-time high back in 2021.

This prolonged drop happened when the entire market crashed amid the Terra-LUNA collapse, putting all cryptocurrencies in a bear cycle. Now, EGLD is trying to recover from these levels, currently trading at $26.57 – below its 30-week exponential moving average.

Learning from past mistakes and moving to a new crypto bull cycle

The recent revelations shed light on what could have sparked three years of poor price action to MultiversX. Interestingly, the chain is often praised among analysts and experts for its technology, being called the “Holy Grail of crypto” by Europe’s oldest crypto fund founder and CIO.

Nevertheless, it is unlikely that the FTX market manipulation caused the crash alone, and other economic factors should be considered. Incentive rewards like airdrops and other inflationary tokenomics can create strong selling pressures even when there is no market manipulation.

On the other hand, it is known that FTX, Alameda, and Sam Bankman-Fried had large positions in Solana (SOL), being one of SOL’s strongest sources of demand in the previous cycle.

Insights, as shared in this podcast episode, are of immense value in understanding history and learning from past mistakes. Analysts speculate that a bull market could be starting and an altcoin season is “just around the corner.” More than ever, investors should study these cases and prepare for what could be the start of a new cycle.

The post Crypto executives unveil FTX market manipulation from the early days appeared first on Finbold.