In a recent note that has caught the attention of both traditional financial markets and the Bitcoin community, Goldman Sachs economists, including the renowned Jan Hatzius and David Mericle, have made a significant prediction regarding the Federal Reserve’s monetary policy. The note suggests that the Federal Reserve may commence a series of interest rate cuts by the end of June 2024.

“The cuts in our forecast are driven by this desire to normalize the funds rate from a restrictive level once inflation is closer to target,” the Goldman economists wrote. This statement underscores the bank’s belief that the Federal Reserve’s current stance on interest rates may be too restrictive, especially if inflation rates continue to trend towards the central bank’s target.

The note further elaborates: “Normalization is not a particularly urgent motivation for cutting, and for that reason we also see a significant risk that the FOMC will instead hold steady.” This cautious tone suggests that while Goldman Sachs is predicting a rate cut, they also acknowledge the unpredictability of the Federal Reserve’s decisions.

The recent data, which showed US inflation rising at a slower-than-expected rate of 3.2%, with the core consumer price index at a 4.7% annual pace, further complicates the picture. With the Fed’s benchmark rate currently set between 5.25% to 5.5%, Goldman Sachs expects it to stabilize around 3 to 3.25%.

What Does This Mean For Bitcoin Price?

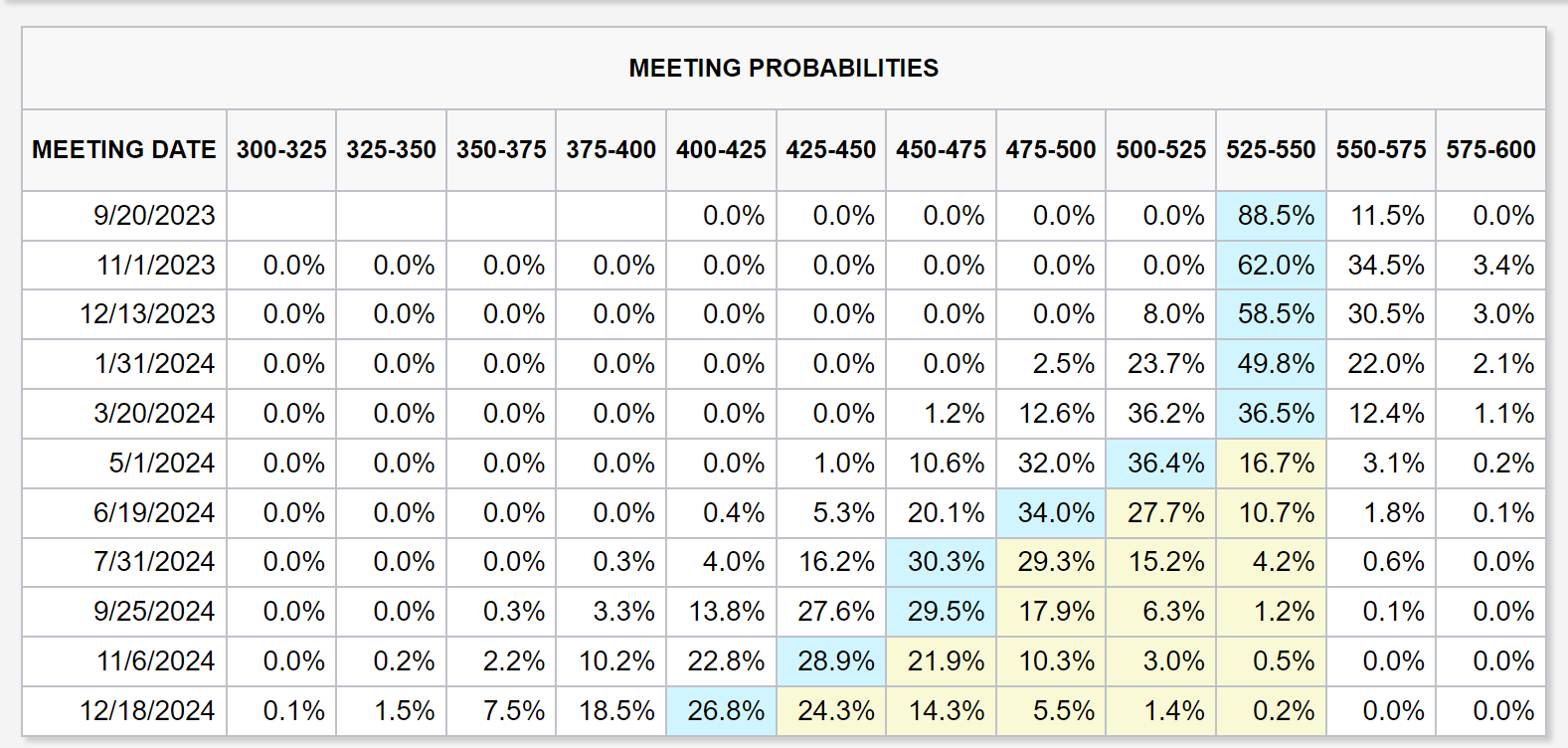

Expectations of a rate cut from Goldman Sachs are in line with market expectations according to the CME FedWatch Tool. In May 2024, 68% already expect there to be at least a 25 basis point (bps) rate cut.

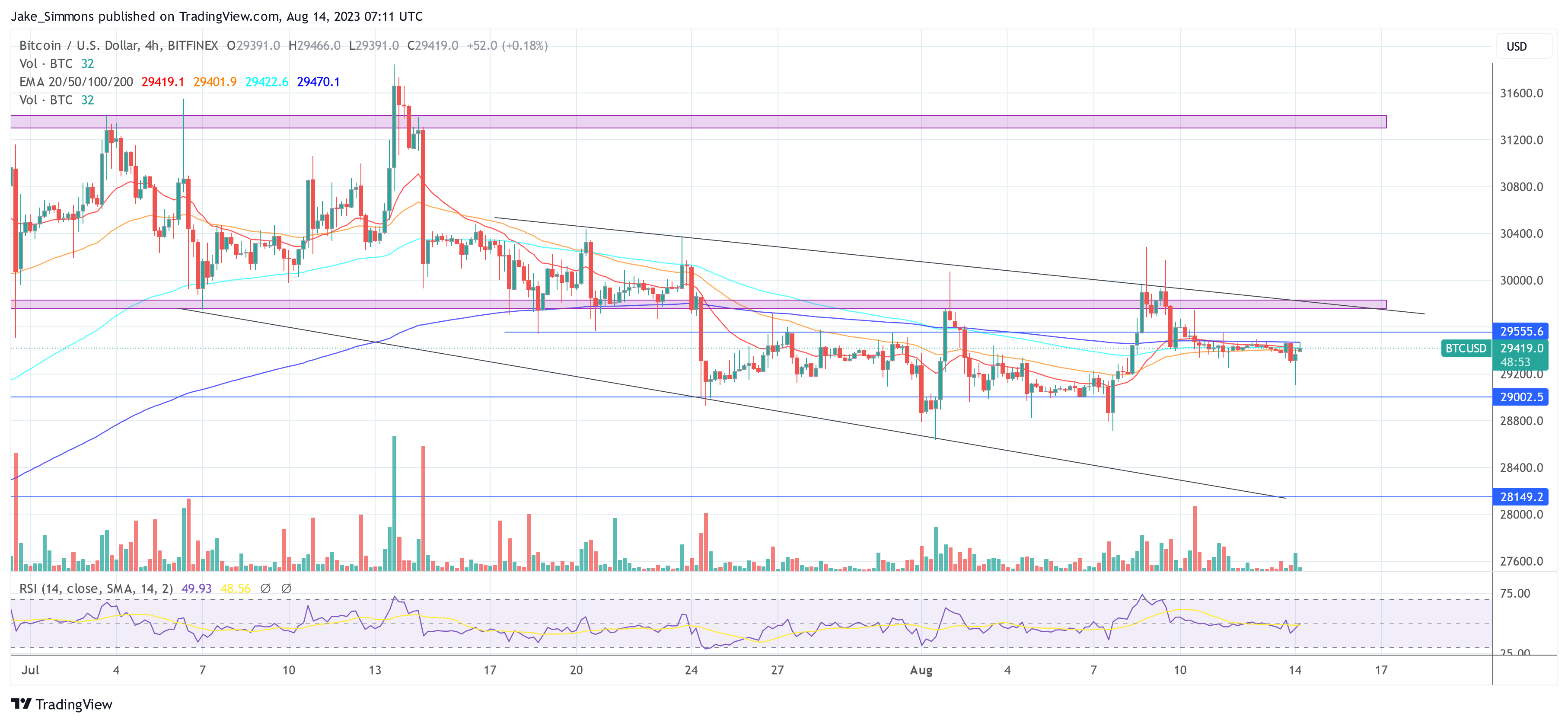

However, it remains to be seen whether macro events will influence the Bitcoin price again. In the last few months, BTC increasingly decoupled from macro events while the stock market rallied towards all-time highs and stagnated around the $30,000 mark.

Interestingly, the timing could be very positive for the Bitcoin market. On the one hand, March 15, 2024 is the final deadline for spot Bitcoin ETF filings from BlackRock, Fidelity, Investco, VanEck, and WisdomTree; on the other hand, Bitcoin halving is coming up at the end of April (currently expected on April 26).

The high expectations for these two events, coupled with a dovish monetary policy from the Federal Reserve, could be a massive catalyst for the Bitcoin price.

At press time, BTC traded at $29,426 and saw another calm weekend amid the liquidity summer drought. Breaking above $29,550 is key to establish any bullish momentum to initiate another push towards $30,000.