Bitcoin’s (BTC) price remains highly volatile, with an analyst suggesting that a well-defined further drop could eventually be bullish for the digital currency.

Notably, in recent trading sessions, Bitcoin has struggled to reclaim the critical $100,000 resistance level, which remains a pivotal threshold for reaching new highs.

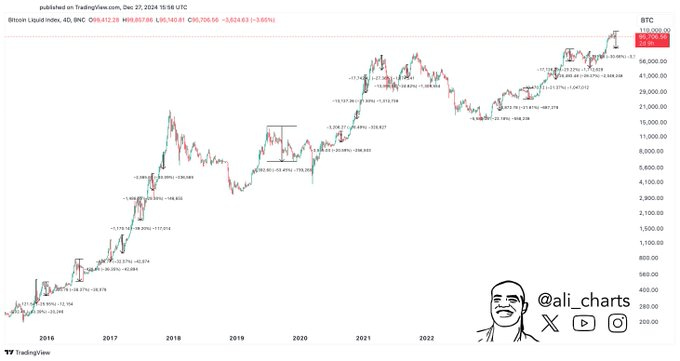

Now, prominent cryptocurrency trading analyst Ali Martinez has highlighted that, based on historical trends, a Bitcoin correction of 20% to 30% could be “the most bullish thing” for the asset, as shared in an X post on December 27.

As per the analysis, it can summed up that regular price corrections are a hallmark of a healthy market.

“A 20% to 30% correction is the most bullish thing that could happen to Bitcoin,” he said.

In this line, Bitcoin has historically shown a recurring pattern of strong rallies followed by notable retracements, typically in the 20% to 30% range. Following such trends, Bitcoin has often surged to new highs.

This pattern, observed multiple times since 2016, suggests that Bitcoin’s current price movement could follow a similar trajectory.

What next for Bitcoin?

At the same time, Martinez identified key levels that investors should watch closely. His December 27 post warned of “free-fall territory” if Bitcoin falls below $92,730.

“You don’t want Bitcoin to dip below $92,730—it’s essentially free-fall territory if that level breaks,” he cautioned.

Using data from the UTXO Realized Price Distribution (URPD) chart, he pointed to a gap in realized price activity between $92,730 and around the $105,000 mark. This void indicates a dip below $92,730 could lead to a sharp decline, potentially dropping Bitcoin to the $60,000 zone.

Despite the short-term bearish outlook, Bitcoin has had an impressive run in 2024, adding over $1 trillion in market capitalization. The rally has been fueled by the latest halving cycle and optimism stemming from Donald Trump’s election victory, with his administration pledging to implement pro-crypto policies.

Looking ahead, analysts maintain a bullish outlook for Bitcoin, particularly with expectations of increased institutional adoption under a pro-cryptocurrency government.

To this end, as reported by Finbold, banking giant Standard Chartered predicts Bitcoin could reach $200,000 by the end of 2024.

Bitcoin price analysis

As of press time, Bitcoin was trading at $94,249, down 0.15% in the past 24 hours but up 1.75% on the weekly timeframe. However, the short-term technical setup shows that Bitcoin is still in trouble.

For instance, Bitcoin’s current price is below its 50-day simple moving average (SMA) of $94,670, signaling mild short-term weakness.

Additionally, the Fear & Greed Index at 72 (Greed) reflects optimistic sentiment, while the 14-day relative strength index (RSI) of 44.41 indicates neutral to slightly bearish momentum.

Despite this, Bitcoin remains well above its 200-day SMA of $70,978, maintaining a bullish long-term trend. In the short term, caution is advised as Bitcoin approaches critical support levels at $92,000 and $90,000.

Featured image via Shutterstock

The post Why Bitcoin correcting by 30% ‘is the most bullish thing’ for BTC price appeared first on Finbold.